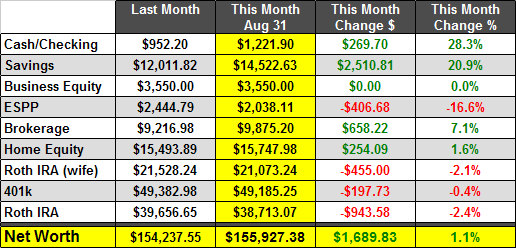

Not a particularly exciting month. Most of our investment accounts dropped a little, but we were able to make up for it with some extra contributions to our savings account. I am getting kind of sick of seeing my 401k and Roth IRA hovering just below $50k and $40k respectively. I’d like to see them breakthrough those barriers.

Hey Clint, when you calculate your home equity, are you varying the market value of the house each month? I realized I probably “should” do this and was considering using zillow.com as an “independent” source for my month to month value. But just using a set conservative value is a lot cleaner.

Ray, for calculating home equity, I am actually showing the amount of the mortgage that has been paid off. It doesn’t account for the down payment, or any variation in the market value of the home. The home’s value has increased, so it’s simply a conservative number that is easy to calculate.

Interesting. So, the loan amount minus the current balance? Never would have guessed that. If you made a sizable down payment and the market value of your house has increased, that’s an extremely conservative net worth evaluation of the house. Especially if you refinanced recently to get a lower interest rate (as I have)…