An important part of determining your asset allocation is knowing your risk tolerance. Unfortunately, you never really know your risk tolerance until you start watching your money disappear. When markets are climbing, everyone thinks they have a high risk tolerance and they load up on stocks because it’s not worth getting some safety from investments like bonds which have lower returns.

If, during these rough times, you find yourself wanting to sell your stocks or move all your money to safer investments, you can be assured that your asset allocation did not match your risk tolerance level. Take the time now to be aware of it and stick to a better asset allocation, even when things get better and you’re tempted to go all the way back into volatile investments.

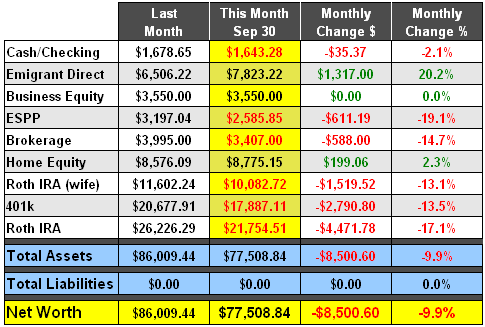

For us, and probably most of you, October was brutal to our net worth. We suffered a loss of nearly 10% of our net worth. But, I still feel pretty confident in our asset allocation. As I’ve stated many times before, we’ve got a long time horizon and today’s market declines will most likely have very little to do with where we end up.

Here’s a fun little chart of my Roth IRA. The yellow dots track my contributions and the blue dots track the actual value. Nasty little plunge at the end there…

Good times…

Well put. It reminds me of how financial advisors and columnists are now writing that people should diversify into bonds and treasuries. Erm, a bit late for that – now is the time to be upping your investment into historically reasonably cheap equities. Next time the bull has a head of steam up, that’s the time to start shifting some of the money over to fixed income and other assets, in my view.