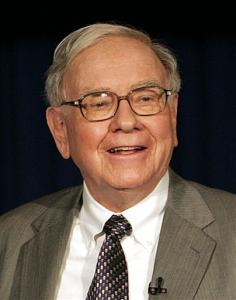

Warren Buffet also known as “The Oracle of Omaha,” with a net worth of around $36 billion, ranks as the second third richest man in the world, just behind his friend and bridge partner Bill Gates. He came from a small town, leads a relatively simple life, and never forgot his roots, not only that he is also a great philanthropist.

Arguably the greatest investor of all time, Buffet is chairman of Berkshire Hathaway. With his uncanny ability to detect undervalued companies and purchase them on the cheap, over his five-decade career, Buffet has gone on to make many people very financially comfortable. Yet his annual salary as Berkshire Hathaway’s chairman and CEO is only $100,000.

At the age of 77, he has the appearance of a white-haired, congenial grandfather figure, and he still lives on Farnam Street in Omaha, in the same gray stucco house he bought almost forty years ago for $31,500. His staple diet consists of steak or burgers with his favorite drink- Coca-Cola — a company he’s invested in since 1988.

If Buffet’s lifestyle seems a little down to earth and even quaint, then so may seem his investment strategy. Not one to listen to the babble and hum of rumor or to follow the whim of macroeconomic trends and Wall Street fads, Buffet’s eagle eye picks out undervalued companies with low overhead costs, high growth potential, strong market share and low price-to-earning ratios, this is because he knows that eventually the rest of the world will catch on.

Warren Edward Veirdo Buffet was born on August 30, 1930, in Omaha Nebraska, the only son of three children, to Leila and Howard Buffet. His father was a stock broker who also became a member of congress. The young Buffet showed his first steps towards the entrepreneurial spirit when he made his first stock market investment at age eleven.

Buffet graduated from the University of Nebraska then went to Columbia University to do a Masters degree in Economics. It is there that he met the influential investor Benjamin Graham. It was while working in Graham’s company “Graham-Newman”, that Buffet honed his now legendary investing skills.

After Graham’s retirement, Buffet returned to Omaha and started a limited investment fund partnership with the aid of a small group of family and friends. Over a period of ten years “Buffet Partnership Ltd.” accrued substantial returns for its investors, after which time Buffet liquidated the fund and took control of textile company Berkshire Hathaway.

This was a troubled time for the textile company and Buffet was well aware of this. Using his innate ability for investing wisely, he wound down the textile company and shifted the portfolio of investments to carefully selected companies over a period of years to include Coca-Cola, American Express, Gillette and The Washington Post. Berkshire Hathaway still owns major holdings in each of these major brand companies.

Admirably, Buffet is also a great philanthropist. In 2006 he made the decision to donate around $37 billion of his shares of the Berkshire Hathaway Foundation to five charitable foundations, the largest of which will be the Bill and Melina Gates Foundation.

—

Corinna Underwood is a writer from Debt Management Talk, a forum where you can discuss anything on personal finance.

i want some tips on how to into an investment with all this stock companies. unlike american express,and berkshirehathaway. i need a guard from the professionals on how to start with to avoid mistake.

when to go into it,and how to monitor it.

thanks.

i realy want to emberk into investment, but i need time to time professional guard to avoid mistake as a starter.i am already a forex trader and i want move ahead to a wise investor through your guard.